Safeguarding Against Financial Crime in B.C. Casinos

Working with our partners in the system, BCLC continues to evolve programs to safeguard B.C. casinos from financial crime.

Since 2012, BCLC has put processes in place which have resulted in a dramatic decline in suspicious transactions in B.C. casinos. We continue to work with police, regulators, industry partners and government to address recommendations to improve and invest resources to track and enhance controls which helps to keep B.C. casinos and communities safe.

What is money laundering?

Money laundering is the process of concealing the origin of money obtained from criminal activity and converting it to appear as if it was acquired through legal means. Money laundering is a crime that affects multiple sectors of the economy.

Proactive measures

In 2012, BCLC changed its policy to enable B.C. casinos to offer Patron Gaming Fund (PGF) accounts. A PGF account is for gaming use specifically and exists to facilitate gaming play, not to provide financial services typically offered through personal bank accounts. With PGF accounts, players no longer take large amounts of cash in and out of the casinos. They are able to hold money in their PFG accounts to use while at the casino.

This includes suspicious indicators like the exchange of small-denomination bills for large-denomination bills and the passing of casino chips between patrons. We also take steps to know our players, including using various intelligence tools and methods to confirm player details and source of wealth.

BCLC employs internationally certified investigators and intelligence analysts for its anti-money laundering unit. BCLC also requires and supports all casino employees with anti-money laundering training to identify, report and help prevent money laundering

This BCLC policy prevents individuals from using large cash buy-ins, participating in minimal play and cashing out to receive generic casino cheques.

Since 2015, specified individuals cannot buy-in with any amount of cash unless they disclose their source of funds.

In June 2022, the Commission of Inquiry into Money Laundering in B.C. produced its final report. Three of the Commissioner’s 101 recommendations were directed at BCLC.

Added checks and verification

BCLC bans individuals from casinos whose presence is undesirable. This includes individuals suspected of criminal activity, believed to be a public safety risk or members of organized crime groups. Since 2014, BCLC has barred more than 1000 individuals from B.C. casinos.

BCLC implemented this policy in 2018 in response to the German Report’s recommendation, requiring casino operators to complete a Source of Funds Declaration for all cash and bank draft/certified cheque buy-ins of $10,000 or more. Casinos also have the discretion to ask anyone to provide the source of their funds, regardless of the amount.

This BCLC policy prevents individuals from using large cash buy-ins, participating in minimal play and cashing out to receive generic casino cheques.

Before players can access their account, BCLC reviews the player’s government-issued photo ID and credit history. With verified accounts, BCLC can effectively oversee all transactions and players on PlayNow.com.

What’s next?

BCLC will continue to take action to safeguard against financial crime in B.C. casinos.

We invest substantial resources to monitor and enhance our anti-money laundering controls. BCLC is working to implement a new transaction-monitoring system that will enhance our ability to assess potential risk from player transactions and activities.

Commission of Inquiry into Money Laundering in B.C.

In May 2019, the provincial government announced the Commission of Inquiry into Money Laundering in British Columbia to make findings of fact and recommendations regarding the issue of money-laundering across multiple sectors of B.C.'s economy. In June 2022, the Commission of Inquiry into Money Laundering in B.C. produced a final report of its findings.

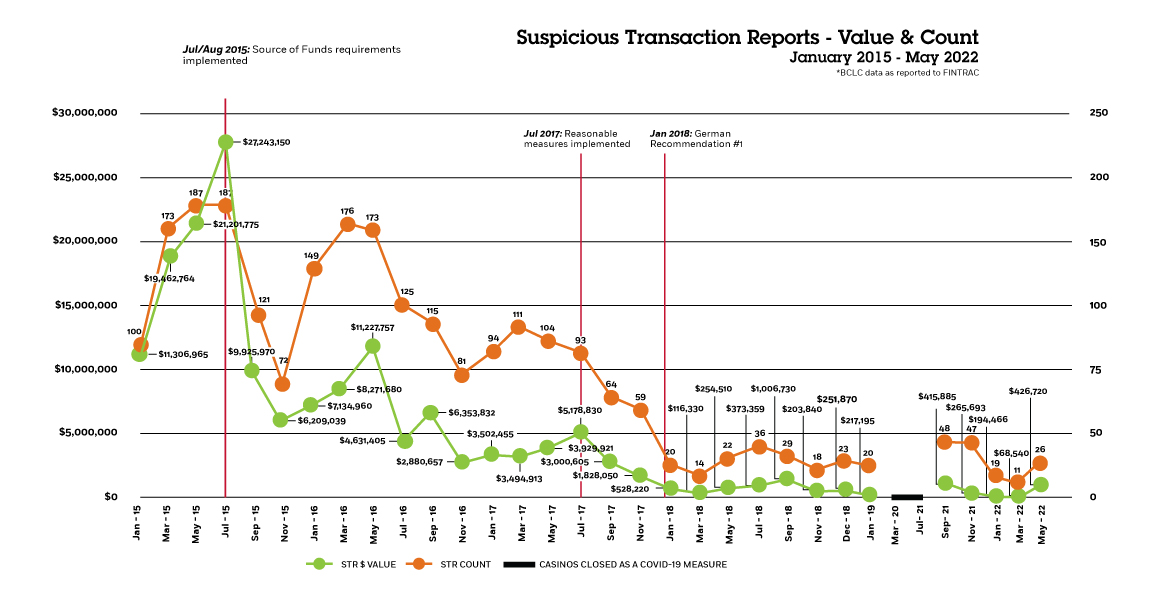

Suspicious Transaction Reports

BCLC sends suspicious transaction reports (STRs) to the Financial Transactions and Reports Analysis Centre of Canada (FINTRAC) based on reasonable grounds to suspect the transaction(s) are related to a money-laundering related offence, including proceeds of criminal activity and fraud. These reports are important in assisting FINTRAC with the detection, prevention and deterrence of money laundering.

While STRs can assist in the detection, prevention and deterrence of money laundering, an STR does not mean that a money-laundering offense has occurred.

Suspicious transactions have declined by more than 99% since 2015 and remain low today.

*The above chart is displayed to show a downward trend of STRs. The reporting frequency is set to change from once every two months to annually (May) moving forward.